Posts

Our very own Casino Master no deposit hunters had been providing their finest finest in collecting the fresh private incentive also offers, you are able to find nowhere else. Selling before maturityCDs sold prior to readiness try at the mercy of an excellent mark-down and may end up being susceptible to a hefty get otherwise losses on account of interest transform or other issues.

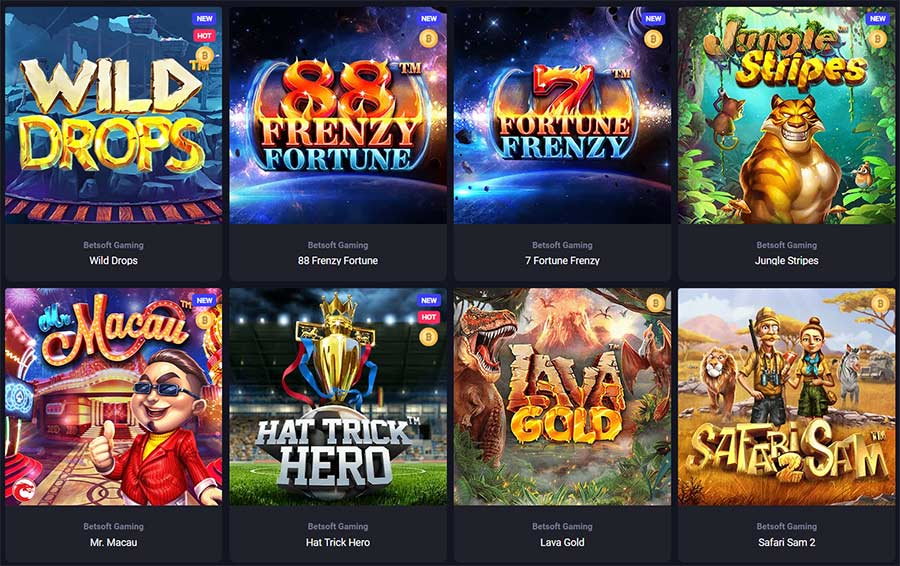

Once understanding of your own is attractive courtroom’s decision, Trump said he would fast put together a bond, comparable securities, or dollars. A great four-courtroom committee out of appeals evaluator consented Tuesday to put the newest collection for the hold when the Trump puts upwards $175 million inside ten weeks. It actually was a significant reprieve, specifically because the one of many judges got refused Trump’s before provide of a good $one hundred million bond. Remember this extra always pertains to position game and that is dominantly available while the 100 percent free No deposit spins for the particular titles. To your rarely instances, you might allege a no-deposit extra in the form of bonus cash to own spending on real time online casino games and you will desk game such blackjack and you can roulette. So if you features form of choices to have game, we recommend provided video game among their hallmarks for choosing a no deposit bonus.

- Having Zynlo’s Roundup Offers, people that have one another highest-give checking and offers membership of Zynlo may provides their debit card orders game as much as the new next money, to your change likely to its offers.

- You can always access their money inside a family savings at the at any time.

- Banks’ projections regarding the second half out of 2022 conveyed a good decline borrowing from the bank attitude, and that led banks to boost mortgage losings provisions.

Price history for Synchrony Bank’s Video game membership

The amount of credit risk within the workplace exposures has expanded in the middle of large rates, tighter credit criteria, and a structural change in any office business due to functions at home and hybrid functions possibilities. Concurrently, large firms lowered the internal mortgage chance ratings for the majority of CRE property brands and some C&We sectors, such as healthcare and you will development, regarding the next one-fourth out of 2022. Your bank account is safe if the lender try covered by the new Federal Put Insurance coverage Corp. (FDIC) or perhaps the Federal Borrowing Connection Management (NCUA).

ACH Circle Sees Good Begin to 2025; Volume and value Expands for both Simple and Same Day ACH

Because the places try debt of your own giving lender, rather than the newest brokerage, FDIC insurance rates can be applied. A certification of deposit try a bank account that really needs you so you can secure money away for a predetermined age of weeks otherwise many years in exchange for a fixed interest which are more than almost every other bank account. CFG Bank is actually a local financial situated in Baltimore, Maryland, that gives aggressive Cds on the internet all over the country. Unlike of many banking institutions, CFG’s Computer game lineup is restricted within the variety, without Dvds reduced than just 1 year, nonetheless it makes up about because of it which have competitive rates.

Enhanced CET1 investment drove the brand new quarter-over-one-fourth rise in the new aggregate CET1 money ratio. Within the first one-fourth of 2023, of a lot Higher Banking Communities smaller or stopped show repurchases simply because of heightened macroeconomic suspicion. Whether or not High Establishment Oversight Complimentary Panel (LISCC) businesses got in the past slowed down or suspended share repurchase within the prior residence, several LISCC companies have increased share repurchases in the 1st one-fourth from 2023. Preferred security tier step one (CET1) funding rates increased modestly while the stop of 2022. The fresh aggregate CET1 financing proportion on the test calculated several % to your February 30, 2023, which had been somewhat higher than last quarter’s level and you may pre-pandemic account.

The newest FDIC is even after the other style within the bank issues, in particular, the brand new procedures organizations is delivering to support financing and you may liquidity inside the days of market instability and you will https://happy-gambler.com/batman/rtp/ uncertain put mindset. The fresh FDIC rates the rates on the DIF of resolving SVB as $20 billion. The fresh FDIC prices the price of fixing Trademark Financial becoming $dos.5 billion. I would stress these quotes is susceptible to high uncertainty and are going to alter, with regards to the best worth know of for each and every receivership. Putting in a bid for Silicone polymer Valley Individual Financial and SV Link Financial closed on the March twenty four. The newest FDIC received 27 estimates away from 18 bidders, along with offers under the entire-bank, personal bank, and advantage profile possibilities.

That have a sail a vacation to package and look toward just had easier. On top of the summer discounts Princess Cruise trips is currently giving to your 2022 and you may 2023 voyages, website visitors will enjoy another $step one deposit give, running Summer 31 – July 5, 2022. It indicates cruisers whom set aside its sailings so you can around the world sites because of the July 5, don’t need to pay the remainder balance until 90 days before their excursion, when places normally vary from $100 – $800 during booking. And, cruisers will enjoy the modern summer savings give of around 40% for the 2022 voyages and you can twenty-five% to your 2023 sailings. On the extent one RateCity provides monetary information, you to guidance is general possesses perhaps not taken into account their objectives, financial predicament otherwise demands. This isn’t a cards seller, as well as in providing you information about borrowing from the bank things RateCity is not making people suggestion or recommendation to you personally in the a specific borrowing from the bank tool.

Customers Comment Strategy

They’re also most commonly discovered that have on line banking companies and you can borrowing unions one to has down overhead costs, enabling these types of financial institutions to give better put cost. I ranked them on the conditions and yearly commission production, lowest balance, charge, digital sense and more. I investigated 126 creditors to test its membership choices, charges, cost, words and you may buyers experience to determine the greatest highest-yield offers profile. Our listing less than boasts eight loan providers and this all have APYs more than 4%, minimal if any monthly charge and you can lower if any deposit conditions. All of our look people as well as held very first-hand lookup because of the beginning accounts at every of them banking institutions (and some someone else).

Interest fluctuationLike all fixed income ties, Cd valuations and you will secondary industry prices are susceptible to movement within the interest rates. In the event the rates of interest rise, the marketplace cost of a good Dvds will generally refuse, performing a potential loss if you to market her or him in the the fresh additional field. Because the changes in interest rates can get the most affect Dvds which have prolonged maturities, shorter-identity Cds are shorter influenced by rate of interest motions. Brokered Computer game against. lender CDA brokered Cd is much like a financial Video game inside the numerous ways. Both spend an appartment interest which is basically greater than an everyday bank account.

The fresh attorneys recommended you to to include guarantee for the bond and you may however remain an amount of money to own their business surgery, Trump would have to provides next to $step one billion within the cash, holds and other liquid assets. Trump, meanwhile, told you for the their Truth Social system which he has nearly $five-hundred million in the dollars but desires a choice of investing some to your their campaign. Trump’s attorneys said he had been struggling to arrange including a large bond.

Claim the advantage appreciate

«However the Bank’s tinge from caution today hints that the next reduce may not started when believe, and you may raises the matter the financial market may have got a little prior to itself.» «The newest UK’s darkening economic outlook and the real danger of an international market meltdown features led the mortgage segments in order to rates inside the a reliable ratcheting off of your ft rates this year. «Then, because the today, the option is never doubtful. However the proven fact that this time two players planned to hold rates of interest in the 4.5% are a puzzle.

It’s too many in this case to find a plus code because the extra has worked and you can performs as opposed to one. To the March 19, the newest FDIC entered to the a purchase and you may expectation agreement for the acquisition of drastically all the places and you may particular financing portfolios out of Signature Connection Bank because of the Flagstar Bank, N.A good. The brand new 40 former twigs out of Trademark Lender began doing work lower than Flagstar Financial, Letter.An excellent., for the Saturday, February 20. Depositors out of Signature Connection Lender, besides depositors linked to the fresh electronic resource banking company, immediately became depositors of one’s obtaining establishment. The newest obtaining business failed to quote on the deposits of those digital resource financial users.